Firms often seek to grow their top line, i.e. their gross revenue derived from the sale of goods and/or services. In a now famous paper, Igor Ansoff (1957) argued that such growth can be pursued along two dimensions – in existing and new markets, and with existing and new products. The resulting 2x2 diagram is widely known as the Ansoff Matrix.

Ansoff’s four growth directions are market penetration (more existing products in existing markets), market development (more existing products to new markets), product development (new products to existing markets) and diversification (new products to new markets).

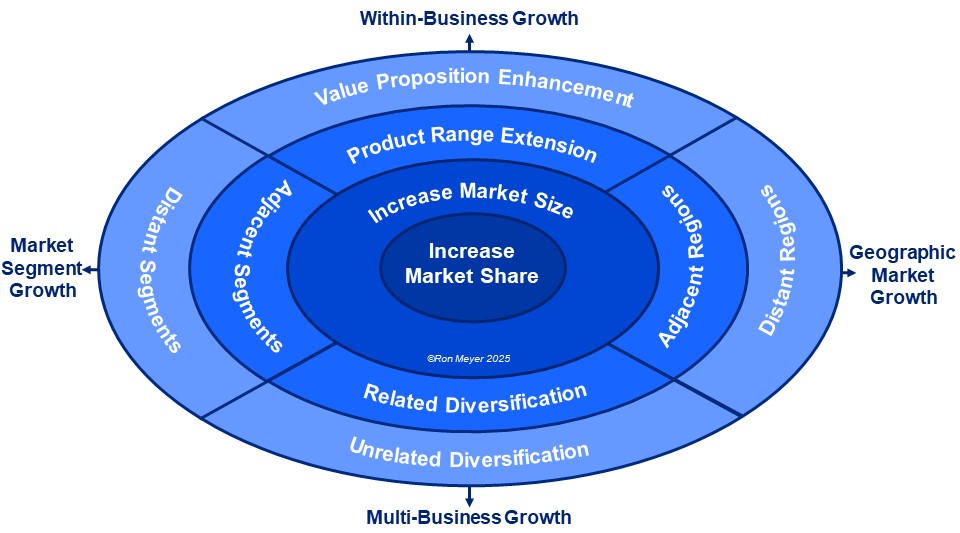

The Top Line Growth Pie builds on Ansoff’s logic of seeking growth along the dimensions of product and market, but splits each category into smaller parts, to give strategists a more fine-grained view into the various growth possibilities. Along the market dimension (plotted horizontally), a distinction is not only made between existing (at the center) and new (around the center), but also between new segments and new geographies. Each is further split according to the extent of newness – adjacent or distant. Along the vertical product dimension, the same is done, making a distinction between new products in or outside the existing business. The underlying metaphor is that firms can grow by taking a bigger slice of the existing pie (increase market share) but also have nine ways of taking a piece of a much larger pie.

The ten growth directions are the following: